Total Loss

Certified Appraisal

& Negotiation

We handle everything to get you a higher total loss settlement.

Hundreds of drivers have trusted us to fight back and win.

- Rated ⭐⭐⭐⭐⭐ (5/5) stars on Google by hundreds of drivers.

- No cost to you, pay when you settle.

- 20+ years of experience.

Forget The Lowball Total Loss Offer.

Insurance companies use CCC and Mitchel valuations to lowball total loss offers — and they fight you at every step.

I negotiate on your behalf using the Appraisal Clause or Right to Appraisal (RTA) in your policy to secure a higher, fair settlement.

It's the only way to get a fair settlement at no cost to you.

Over 100 Google Reviews

Don't Fall For Insurance's Dirty Total Loss Tricks.

👎 Lowball Offers.

An unfair valuation is used to calculate Total Loss and Diminished Value offers.

🔍 The comparables game.

Don't waste your time finding comparable vehicle values.

🤐 Not showing you an appraisal.

By law you are supposed to get the appraisal report they used for your offer.

🧱 Stonewalling.

Waiting on hold for hours, bureaucracy, and misinformation.

We Get You More.

In Three Steps.

1. Free Appraisal

Get a report of comparable vehicle values for free. So you can tell insurance to take a hike with the lowball offer.

2. We Negotiate

Save weeks of stressful negotiations. We handle the independent certified appraisal and the negotiation for you.

3. Insurance Pays

Your insurance sends you a check, much bigger than the intital offer. That's when you pay us and write a glowing review (if you choose).

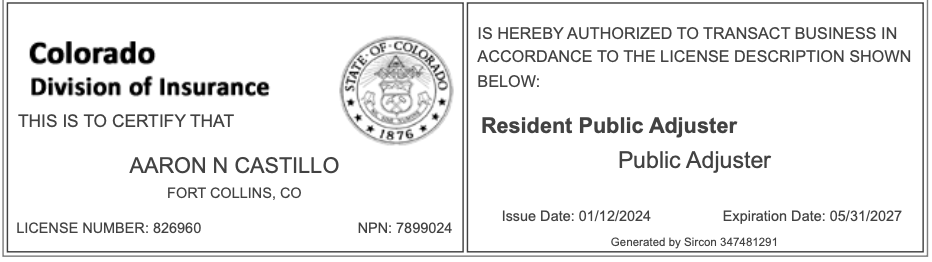

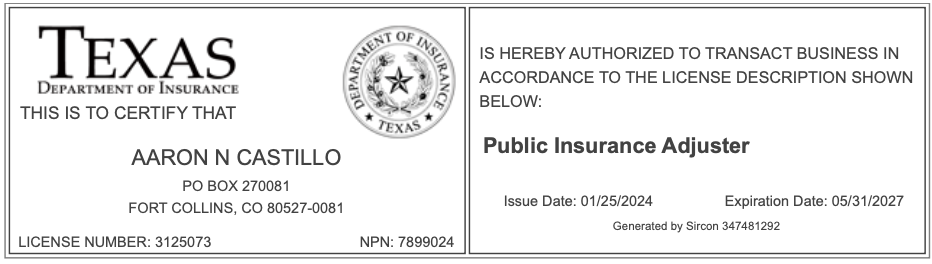

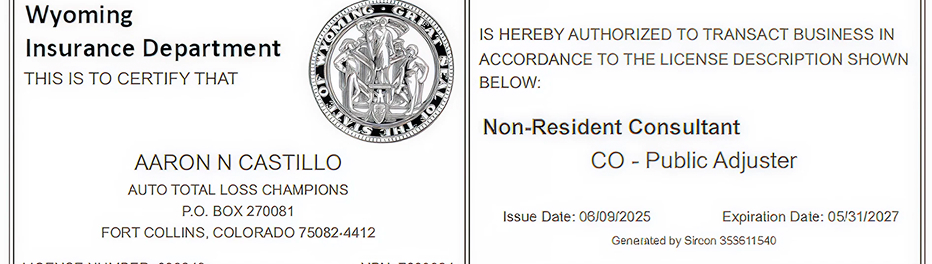

Aaron Castillo — Licensed Public Adjuster

Liscensed in CO, TX, and WY.

Get Total Loss Help At No Cost To You.

Total Loss Appraisal & Claim Negotiation

We only get paid when you do. Our flat fee is based on claim complexity, not settlement amount.

What's included:

- Free Certified Independant Appraisal - no obligations

- Insurance Claim Negotiation - flat fee based on claim complexity

Your Reliable Partner In Insurance Disputes

Licensed Public Adjuster

Licensed Public Adjuster in CO, TX, WY with extensive industry experience.

A+ Better Business Bureau Rating

Proudly holding an A+ rating for service excellence.

Highly Rated by Past Clients

Hundreds of (5/5) star Google reviews reflect our commitment to our clients.

Get a Free

Total Loss Appraisal

Save hours of researching comparable vehicles insurance won't even accept. Takes less than 5 minutes to complete.

Your Total Loss

Questions Answered.

How do I negotiate a total loss payout with the insurance adjuster?

Here's how you can attempt to negotiate yourself:

Step 1. Request the full CCC or Mitchell valuation report.

Step 2. Identify errors (wrong comps, missing options, mileage issues, unfair adjustments).

Step 3. Gather accurate market comps online.

Step 4. Submit a written counter offer with evidence.

Total Loss Champions will do this all for you. We research comparable vehicles for you and help you come up with a reasonable counteroffer. Use our free appraisal service to save hours searching for comparable vehicles.

Important: Adjusters often deny self-researched comparable values. The only remedy is to invoke the "Right to Appraisal" (RTA) or the appraisal clause in your policy contract to force a negotiation.

What does “total loss” mean in auto insurance claims?

A vehicle is considered a total loss when the cost to repair it is too close to—or exceeds—its actual market value.

Insurers declare a total loss when repairs plus supplemental costs hit about 70–80% of the vehicle’s value. Instead of paying for repairs, they offer you a settlement based on their valuation.

With rising repair costs total loss is increasingly common.

How can I tell if my car is a total loss after an accident?

Even seemingly minor accidents can result in a total loss. You can make a guess if the the insurance company will total your car.

Step 1. Find your car’s value using KBB, CarFax Value, Autotrader, or marketplace comps.

Step 2. Estimate repair costs.

If repairs are 70% or more of the car’s value, it’s likely a total loss. Look for adjuster signals: bent frame, deployed airbags, heavy panel damage, or high labor hours all point to a total loss.

Important note: Your adjuster may not accept KBB, CarFax, or similar values in negotiations. In that case your only remedy is to invoke the "appraisal clause" or "right to appraisal" (RTA).

Which insurance companies offer the best total loss settlements?

Insurers use the same automated valuation systems (CCC or Mitchell) which leads to low total loss offers across the industry.

No major insurer is known for offering “good” total loss payouts. Alllarge carriers are notorious for low initial offers. We find almost all claims submitted on our website are undervalued.

Can I buy back my car after it's declared a total loss?

You can keep your total loss vehicle but insurance will issue a salvage title and subtract the value out of the settlement payout.

Unless you're someone who likes to tinker with cars or the total loss vehicle is sentimental, most people use their insurance payout to buy an equivalent vehicle.

Don't Let Insurance Take Your Money

Have Aaron, a public adjuster with 20 years of experience, handle your total loss claim for you.

.png)

.png)

.png)

.png)